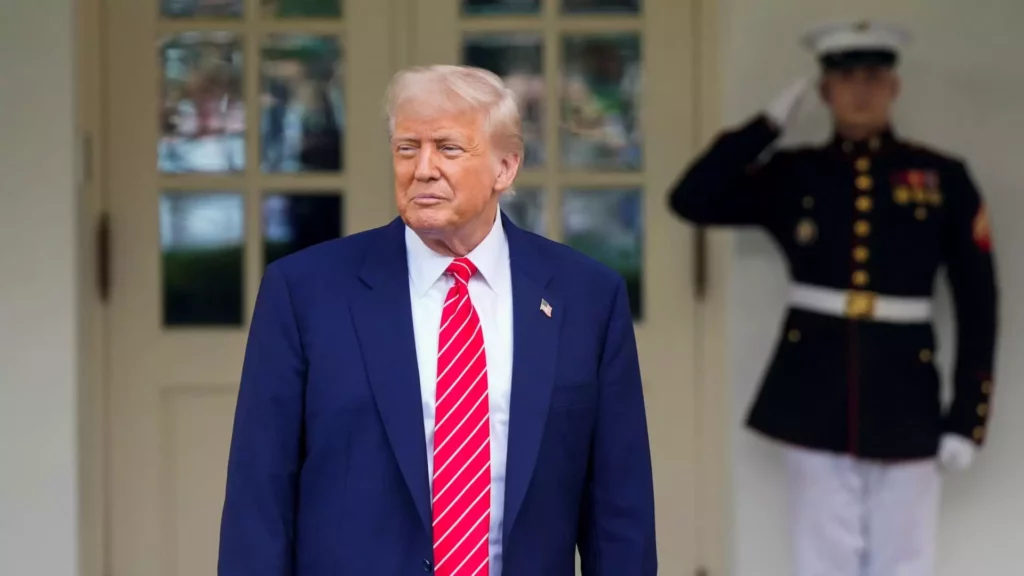

The intricate dance of cryptocurrency regulation in the United States finds itself caught in the crossfire of political maneuvering, particularly amid the enduring shadow of Donald Trump. The recent fallout surrounding the GENIUS Act, intended to provide a lifeline to stablecoins—a growing market of digital currencies pegged to traditional assets—reveals not only the struggle for financial order but also a pronounced entanglement of private interests within the fabric of public policy. Herein lies a worrisome truth: the pursuit of national financial integrity is being compromised due to the personal ventures of those tasked with governance.

The GENIUS Act: A Regulatory Misfire

The GENIUS Act aimed to illuminate the murky waters of cryptocurrency regulations by creating a structured framework for stablecoins. However, the failure of the act to receive the necessary support, ultimately stalling at 48-49 votes, exemplifies our current legislative paralysis. It is disheartening that bipartisan interest, which should ideally drive progress, was instead fettered by concerns over Trump’s financial entanglements in the cryptocurrency sphere. Such ties extend beyond simple allegations. The narrative suggests an intricate network of influence that permeates the highest levels of government, raising the quintessential question of accountability. As critical voices such as Senator Jeff Merkley rally against perceived “corrupt schemes” that threaten public trust, the origin of this dysfunction can invariably be traced back to our leaders’ vulnerability to financial interests.

Trump’s introduction of meme coins, specifically the $TRUMP coin, casts a stark light on the moral ambiguities of our leadership. It is difficult to dismiss claims that these ventures have dual purposes: to enrich the former president and to create an ecosystem where favor can be purchased through cryptocurrency. As other prominent figures—including Melania Trump with her own coin—enter this fray, the interplay between governance and personal profit complicates any efforts to establish a trustworthy regulatory environment.

The Foreign Investment Dilemma

Intriguingly, the implications of Trump’s cryptocurrency ventures extend into international waters. Reports highlight attempts by foreign entities, such as Abu Dhabi’s MGX, to invest in Binance using a Trump-linked stablecoin. This begs a grave consideration: is the sovereignty of our financial systems being compromised for personal gain? This precarious symbiosis of business and governance not only creates an ethical quandary but poses risks to national security. How can we forge ahead as a global financial leader, guarding against misbehavior while tethered to questionable practices?

In a time when political division runs deep, Trump’s unique nexus of personal financial endeavors has served as a galvanizing force against legislative progress. Lawmakers who previously supported the GENIUS Act are now reneging on their alliances, a testament to the growing awareness of how financial interests can eclipse fundamental national priorities. This shift underscores an urgent need for rectifying the relationship between governance and personal profit.

Regulatory Innovations: The End Crypto Corruption Act

In an acknowledgment of these tensions, lawmakers have proposed the “End Crypto Corruption Act,” aimed at disentangling cryptocurrency investments from the hands of elected officials. Advocates for this legislation, such as Merkley and Chuck Schumer, understand that personal gain breeds distrust, fundamentally undermining the efficacy of proposed regulations. Ironically, in their quest to oversee cryptocurrency, lawmakers find themselves grappling with the profound challenge of dismantling conflicts of interest while balancing public welfare and financial innovation—the keystones of modern governance.

This push for stricter regulations poses another dilemma. The more they lean into these policies, the more they risk alienating industry leaders and innovators who are already wary of the environment. The sentiment echoed by fintech experts today is one of frustration: personal motivations among leaders hinder the development of constructive and sound regulatory frameworks. Investors, too, recognize that underpinning stability in the crypto landscape requires guidance that remains untainted by self-seeking ambitions.

Integrity or Profit: The Choice Ahead

The repercussions of Trump’s continued involvement in cryptocurrencies present a decisive moment for both national credibility and the future of U.S. financial systems. As the call for investigations into Trump-linked coins gains momentum—championed by senators like Blumenthal and vocal advocates from across the aisle—there is a notable recognition of the urgency to navigate potential ethical lapses.

Voices from the Democratic party wrestle with the harsh reality that the integrity of financial regulations can no longer be an afterthought, hoping for growth while turning a blind eye toward conflicts of interest. For figures such as Elizabeth Warren and Kirsten Gillibrand, the establishment of comprehensive regulations is not just beneficial for the cryptocurrency industry but is intrinsically tied to the health of democracy itself.

The inevitable question rears its head: how can the U.S. hope to pioneer fair cryptocurrency regulations while entrenched in personal dilemmas? The trajectory forward remains clouded as long as self-interest trumps public duty, instigating a cultural dissonance between what financial honesty ought to be and what it is. The potential for a thriving crypto economy exists, but this burgeoning future hinges not merely upon innovation but upon prioritizing integrity over profit.

Leave a Reply