In a world where the technology sector operates at lightning speed, the recent announcement by former President Donald Trump regarding a potential 25% tariff on iPhones not manufactured in the United States has sent shockwaves across the industry. Contrary to being a mere rhetorical flourish, this proclamation represents a significant escalation in America’s already fraught trade relationships with key manufacturing partners like China and India. As Trump amplifies his criticisms, the prospect of Apple—an emblem of innovation and authority in the tech world—shifting its production entirely to U.S. soil raises profound concerns for investors who prefer stability over disruption.

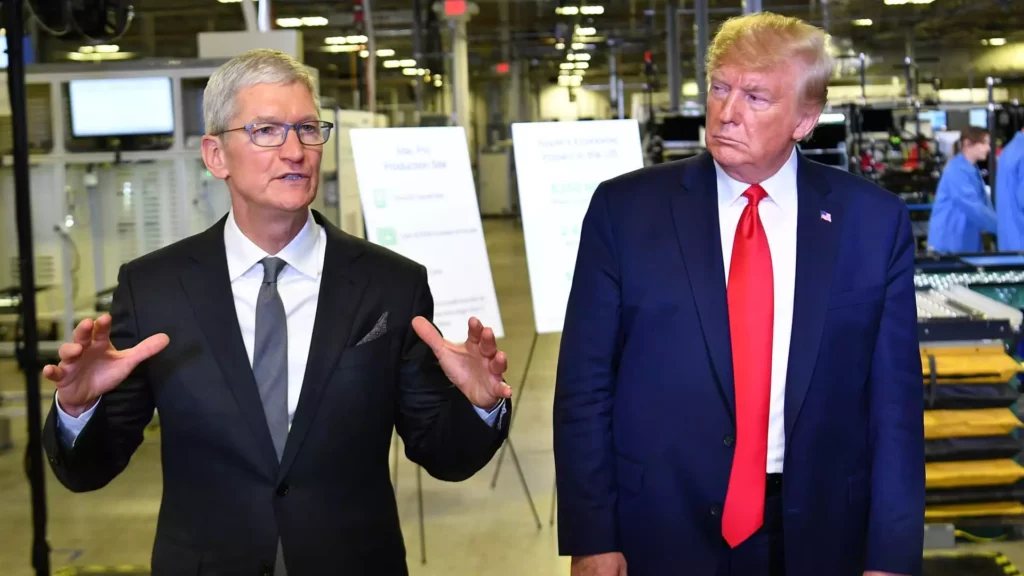

The audacity with which Trump communicates his demands—specifically targeting Apple CEO Tim Cook—shows a worrying trend. Cook’s previous financial support for Trump’s policies now seems to form a precarious foundation, with the expectation that the tech titan pivot abruptly to align with nationalistic trade policies. However, it leaves us grappling with the larger underlying question: can companies realistically navigate such instability while maintaining their competitive edge?

The Real Cost of Patriotism

The logistics of pulling manufacturing out of China and relocating it to the U.S. are riddled with complications that go beyond mere political rhetoric. Industry experts estimate that U.S. manufacturing costs could drive the price of an iPhone sky-high—some predictions suggest up to $3,500 for a single device. This staggering figure starkly contrasts with the current average retail price of around $1,000, effectively transforming a basic communication tool into a luxury item.

Imagine the households that rely on these smartphones for work, education, and connectivity; a $3,500 iPhone would not just be a dent in personal budgets but a genuine barrier to accessing vital resources. This alarming potential shift is not simply a manifestation of trade policy; it’s a direct threat to everyday consumers who would face technological exclusion due to government mandates.

Furthermore, such shifts in policy direction ignite fears that the well-worn path toward affordable technology is being obliterated, pushing the U.S. further towards a dystopian future where digital literacy and access become a privilege instead of a right.

The Political and Economic Minefield

By threatening tariffs that implicate Apple along with broader categories, Trump appears to revitalize past wounds from previous trade disputes. A call for a 50% tariff on EU products consolidates this aggressive approach, which many thought had subsided. The renewed hostilities could derail established trade negotiations and provoke retaliation that would prove destructive for both sides.

Critically, the immediate effects of such aggressive tariff rhetoric were felt on Wall Street, with Apple’s stock experiencing a disheartening dip of approximately 3% in premarket trading. Investors’ fears of volatility set the stage for a chilling business environment, one where consumer confidence could teeter on the edge of collapse. With the market’s performance echoing the sentiments of daily investors, one cannot ignore the possibility of long-term ramifications should these tensions escalate further.

As Apple braces for additional costs—estimates project that tariffs could impose an immediate financial burden of approximately $900 million in just one quarter—the specter of economic downturn looms ominously. Coupled with declining demand in a critical market like China, the landscape appears increasingly treacherous.

The Disconnection Between Corporate Strategy and Consumer Needs

Given the trickle-down effects of these policies, it’s imperative to focus not merely on corporate profit margins but on the average consumer’s reality. With rising prices due to tariffs that are incentivized to be passed onto consumers, the conversation must shift. Technology, once the great equalizer—democratizing access to information and connectivity—is at risk of becoming an exclusive commodity.

The contrast is striking: while corporations like Apple wield vast resources to navigate these challenges, it is often everyday consumers who find themselves suffocating under burgeoning costs. As iPhone prices inflate, we risk establishing a new digital divide that could erode the fabric of societal equality that technology had previously begun to mend.

While the dialogue around tariffs conventionally consists of punitive measures focused on corporate accountability, it is becoming increasingly critical that these discussions encompass solutions that prioritize both domestic manufacturing and improved consumer accessibility. The stakes are high, and the pressure on Apple to navigate this complex web of political affiliations and economic burdens will undoubtedly redefine the landscape for technology in America.

This evolving situation underscores an urgent need for a more nuanced and responsible approach to trade policy—one that does not just penalize industries but rather fosters an environment where manufacturing can flourish without sacrificing consumer access.

Leave a Reply