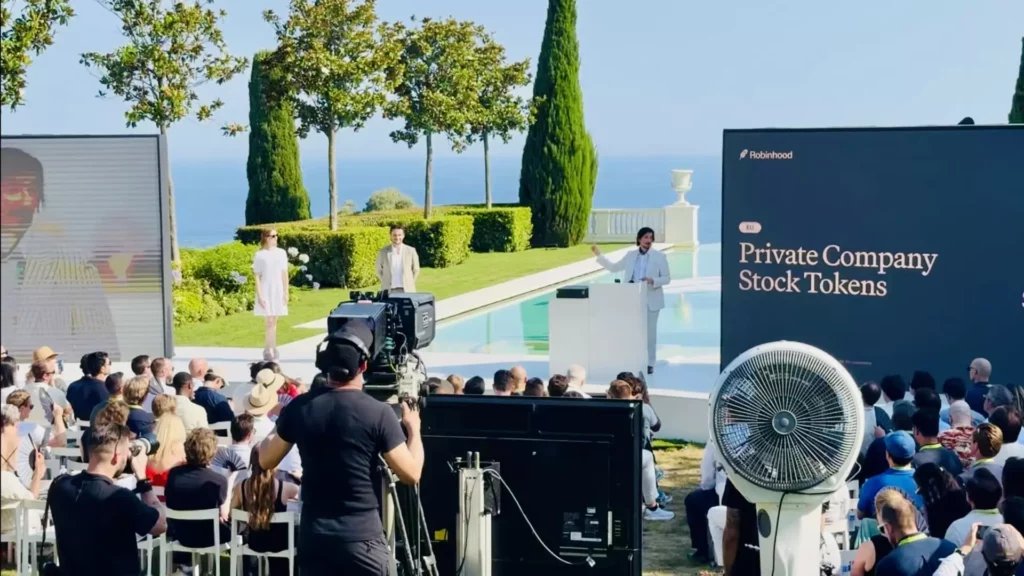

Robinhood’s introduction of tokenized shares for colossal private companies like OpenAI and SpaceX in Europe represents a watershed moment in the democratization of access to private assets. This move challenges the status quo of exclusivity that has long governed private equity investments traditionally confined to institutional investors and high-net-worth individuals. However revolutionary it sounds, one must critically examine whether this genuine empowerment of retail investors is as idealistic as it seems or if it borders on reckless disruption.

While there is undeniable merit in breaking down systemic barriers, Robinhood’s strategy rides on the promise of blockchain tokenization as an all-encompassing solution. The allure of fractional ownership and 24/7 tradability on a Layer 2 chain like Arbitrum is an impressive technological feat, undeniably pushing forward efficiency and cost-effectiveness. Yet, this technological magic alone cannot neutralize the inherent complexities and risks tied to private equity investments. The challenge lies not just in access but in investor comprehension—a factor often underestimated by fintech disruptors eager to expand their user base.

An EU Regulatory Haven versus U.S. Caution: Testing Innovation or Sidestepping Protection?

Robinhood’s deployment of tokenized shares in the European Union rather than the United States is a telling detail. Europe’s relatively permissive regulatory framework has allowed Robinhood to sidestep the strict accredited investor limitations imposed by the SEC. This regulatory landscape presents a fertile ground for innovation, arguably accelerating financial inclusion for retail investors.

Still, this permissiveness brings perilous questions about investor safeguards to the fore. By circumventing traditional protections, Robinhood implicitly bets on market forces and investor savvy to prevent significant losses. From a center-right liberal perspective, while market innovation is essential, so is prudent regulation that balances opportunity with accountability. Regulation exists not to throttling innovation but to protect consumers and maintain market integrity. The EU’s framework may be an experiment in liberalized innovation, but it risks becoming a cautionary tale if investors are insufficiently warned of the volatility and valuation challenges inherent in tokenized private shares.

Technical Brilliance Meets Practical Concerns

The decision to use Arbitrum’s Layer 2 blockchain to underpin these assets demonstrates Robinhood’s advanced technical vision to solve longstanding blockchain adoption problems: slow transactions, high costs, and poor scalability. This infrastructure is vital in making tokenized equity realistically tradable for ordinary users.

Yet, technologically sound does not necessarily equate to universally sound. Custody of these tokenized shares directly in users’ wallets is innovative but also burdens users with responsibilities traditionally handled by brokers or custodians. While decentralization aligns with crypto ideals, the average investor may face friction in understanding security protocols or recovering lost assets. This partly shifts investor risk from the market to the individual’s capacity to manage digital assets responsibly—a risk disproportionately felt by less financially literate users.

Financial Inclusivity and Inequality: Genuine Progress or Illusion?

Robinhood’s vision—to democratize ownership of transformative companies previously accessible only to elite circles—is compelling, especially against the backdrop of widening wealth disparities. Opening these investment avenues can theoretically spur broader wealth creation and grant retail investors participation in the tech-driven economy’s upside.

However, this vision glosses over the fact that not all investors start on equal footing. Fractional investments in volatile, illiquid private companies wrapped in blockchain tech might enrich a few savvy investors but could equally accelerate losses for the ill-prepared masses. Broad inclusion without nuanced risk management risks widening, not narrowing, economic inequality. From a center-right approach, inclusive finance should empower individuals through education and responsibility rather than paternalistic protection or reckless accessibility.

The U.S. Regulatory Stalemate: A Barrier to Progress or Necessary Prudence?

Robinhood’s struggle to bring tokenized private equity to its home market underscores an enduring tension: innovation vs. regulation. CEO Vlad Tenev’s calls for regulatory reform highlight how outdated rules can hamper legitimate technological progress. It’s tempting to view U.S. regulation as an archaic roadblock frustrating fintech innovation.

Yet, this perspective undervalues the critical role the SEC plays in maintaining trust in capital markets built over decades. The U.S. regulatory framework, though slow, is designed to prevent the kind of exuberant speculative bubbles and investor ruin that rapid fintech innovation can trigger. While frustrated fintech innovators hunger for liberalization, center-right policymakers must weigh the consequences of dismantling carefully engineered investor protections for the sake of faster access.

Education Over Access: The Real Frontier for Disruptive Finance

Robinhood’s bold entry into tokenized shares is exciting and emblematic of where markets are headed—but it also highlights a glaring blind spot: investor education. Democratization of access without enhancing investor literacy invites missteps and disappointment. Complex valuations, uncertain regulatory standards, and volatile crypto market intersections mean retail investors could suffer significant losses without fully understanding the risks they assume.

True financial innovation in this space demands more than blockchain mechanics and reduced minimum investments—it requires a comprehensive commitment to educating investors about what tokenized private company shares really entail. From my perspective, this is the responsible conservative-liberal center ground: harness innovation with safeguards and user empowerment rather than unbridled access.

Robinhood’s Ambition: Revolutionary or Reckless?

Robinhood’s strategy to fuse traditional equity markets with blockchain-based tokenization is bold, even audacious. They have taken a concept that once seemed niche and theoretical and are applying it at scale in a real capital market context. While this represents a powerful step for financial inclusivity, it teeters on a knife-edge between democratizing wealth creation and exposing uninformed investors to dangerous risks.

There is enormous potential for tokenized private equity to rewrite the rules of who gets to build wealth in the 21st century. Yet, if executed without a parallel emphasis on robust investor protections and education, this revolution risks becoming a liability disguised as innovation. Robinhood’s challenge is to strike the right balance—leveraging liberal market dynamism while respecting the prudential boundaries that underpin market stability and individual financial security.

Leave a Reply