For over five decades, Intel has been emblematic of American technological prowess—a powerhouse that revolutionized computing and cemented its place at the industry’s epicenter. Yet, recent financial upheavals reveal a stark reality: Intel is teetering on the brink of irrelevance unless it fundamentally redefines its strategic priorities. The company’s dilemma is painfully explicit. Its traditional strength—massive manufacturing capacity—has become both a blessing and a curse. While the legacy of pioneering process nodes once set the industry standards, current market realities have cast long shadows over Intel’s competence and agility.

The core issue isn’t merely about many failed projects or missed opportunities; it’s a crisis of confidence—both internally and externally. Intel’s inability to attract outside clients for its cutting-edge 14A process node, despite significant investments, underscores a fundamental problem: their manufacturing reputation has been damaged, and trust is waning fast. The company’s dependence on internal demand and outdated assumptions about technological superiority have resulted in a strategic dead end. This isn’t a case of temporary setbacks but a systemic failure rooted in overconfidence and misjudged market timing.

Intel’s decision to pull back from aggressive expansion—halting projects in Germany, Poland, and Ohio—serves as a stark acknowledgment that its previous growth-at-all-costs approach is unsustainable. This recalibration, while painful, signals a recognition that doubling down on legacy methods without aligning capacity with market demand was a reckless gamble. The industry’s shift toward specialized chips, AI accelerators, and flexible manufacturing paradigms means that Intel’s traditional business model must be radically overhauled; otherwise, it risks obsolescence.

Navigating Industry Disruption and Skepticism

The real challenge for Intel does not solely rest within its walls but in its perception within the wider industry ecosystem. Investors responded to the recent financial report with the sharpest stock drop in its history—a staggering 60% decline—highlighting the depths of their skepticism. This decline mirrors a broader erosion of faith that Intel can transform itself into a relevant and reliable partner amidst the fierce competition driven by Nvidia, TSMC, and other advanced chipmakers.

In the current technological landscape, where speed, innovation, and bespoke solutions dictate market dominance, Intel’s inability to produce convincing evidence of future external demand is profoundly troubling. The company’s focus on internal innovation, while crucial, is no longer enough. The external trust that once propelled Intel to industry leadership now seems elusive. Industry players are skeptical of Intel’s claim that it can regain its standing as a strategic partner, especially given its recent record of missteps and underperformance.

This skepticism is compounded by the financial results—widening losses, significant impairments, and layoffs. The $2.9 billion loss and related asset write-downs are not minor setbacks but indicators of a company grappling with fundamental operational flaws. These cuts are symptomatic of a misguided overinvestment spree that, rather than fueling growth, drained resources and diverted focus from core competencies. It is a gut-wrenching recognition that their past investments, applauded as visionary, now resemble miscalculations that could forever tarnish their reputation.

What, then, is the future? Will Intel be able to reinvent itself or continue its slide into industry irrelevance? The partial shift towards demand-driven production—relying on confirmed customer commitments—marks an acknowledgment that flexibility and responsiveness are paramount. Yet, this pivot, while necessary, risks further alienating potential partners who may perceive Intel as unpredictable and inconsistent—a business caught in a vicious cycle of crisis management rather than strategic foresight.

Strategic Failures and the Risk of Peripheral Status

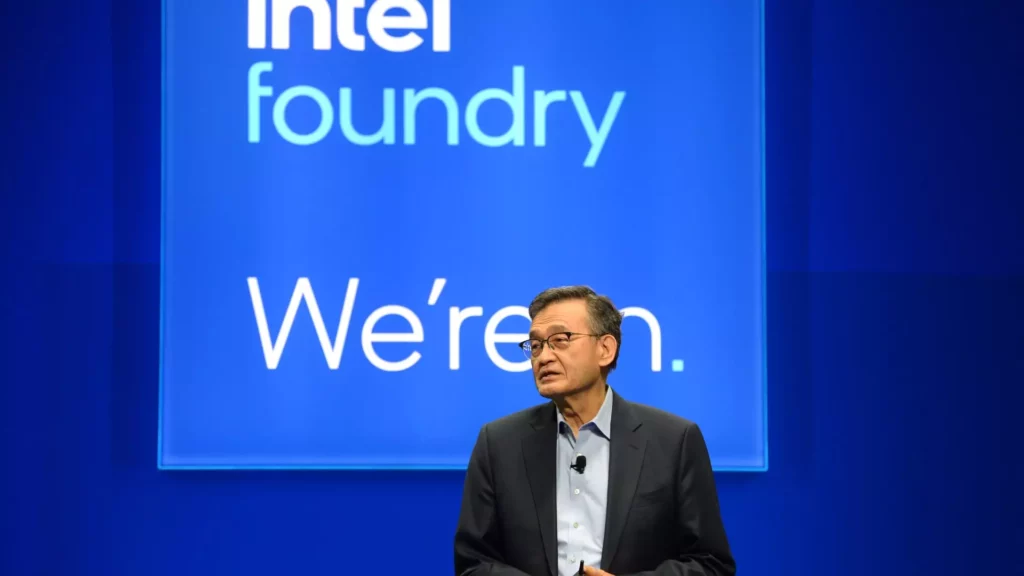

Analyzing Intel’s recent strategic setbacks reveals a pattern of overreach and mismanagement. The overinvestment in expansive manufacturing infrastructure, driven by a desire to retain dominance, resulted in fragmented and underutilized factories. CEO Tan’s candid admission about this inefficiency exposes the core flaw: a stubborn reliance on past advantages in a new industry era that values agility over capacity.

Without external validation and collaboration, Intel risks becoming a peripheral player—an organization that innovates in isolation while industry leaders build strategic alliances and carve out new markets. The current landscape favors flexible, customer-centric approaches, and Intel’s hesitations could lead to a downward spiral of marginalization.

Industry dynamics have shifted toward specialization and rapid innovation. The ascendance of AI chips, bespoke hardware, and rapid prototyping demands not only technological superiority but operational adaptability. The failure to adapt swiftly and convincingly to these trends has left Intel trailing behind, struggling to maintain relevance. Their retreat from broad manufacturing expansion, once an ambitious move, now appears as a defensive measure—an acknowledgment that previous overextensions proved self-defeating.

Intel’s future hinges on whether it can rebuild trust, reposition as a dependable partner, and demonstrate an operational paradigm that values strategic partnerships over insular innovation. Absent these changes, they risk being overshadowed or becoming merely a legacy name—an example of a once-indomitable legacy that failed to evolve swiftly enough. To secure a future that is more than just survival, Intel must accept that industry leadership today requires humility, collaboration, and a relentless commitment to agility, not nostalgia for past glories.

Leave a Reply