The computing industry is bracing for significant price adjustments that may affect consumers on a broad scale. Acer CEO Jason Chen has recently highlighted the likelihood of a 10% price increase for laptops in the United States, attributing this change primarily to the import tax imposed by the current administration. Such tariffs, which are meant to put economic pressure on foreign manufacturing, often have the unintended consequence of elevating prices for consumers, triggering concerns over price gouging across the tech sector.

Chen’s remarks not only forecast a direct impact on pricing but also suggest a darker undercurrent: the potential for price gouging. He speculated that rival companies might use the tariff as a convenient pretext to increase their prices further. The implicit worry here is that competitive pressures could morph into a race to inflate prices, wherein companies exploit geopolitical changes to maximize profits rather than passing on a modest increase reflective of true cost changes. This would take advantage of consumer response to perceived scarcity or heightened demand, a tactic that raises ethical questions regarding corporate responsibility.

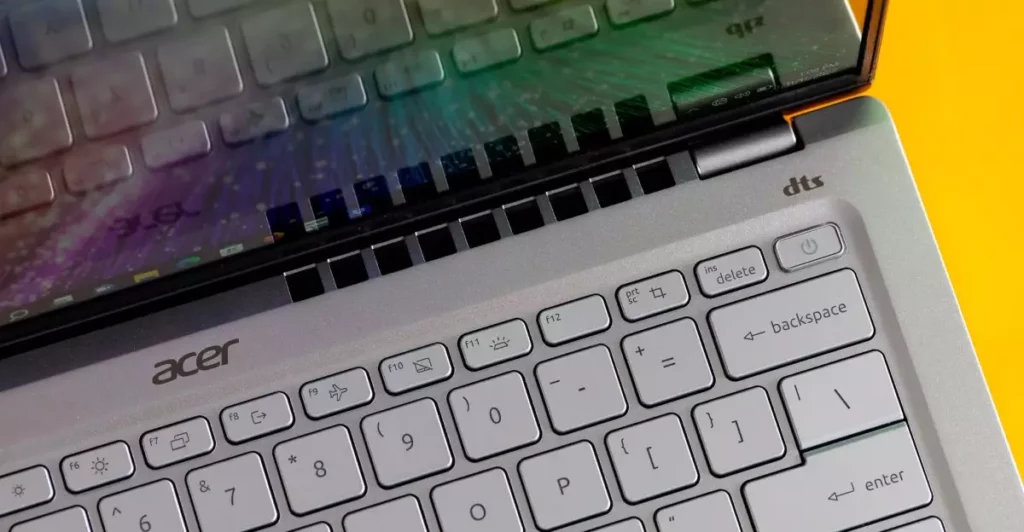

At the heart of this issue is the dependence on overseas manufacturing, particularly in China. Despite Acer’s proactive steps in moving some of its desktop production outside of China, the majority of global laptop assembly remains concentrated there. This places companies such as Apple, Dell, and HP in a precarious position. They face a dilemma: continue relying on a cost-effective manufacturing base while absorbing tariff costs or seek expensive alternatives that may disrupt supply chains. Consequently, companies might shave costs elsewhere, impacting product quality or innovation, in a bid to accommodate rising prices.

The broader inquiry into how other major PC players will respond remains unanswered. Corporate silence from significant players like Apple and Lenovo regarding their pricing strategies post-tariff suggests either indecision or a coordinated effort to navigate this complex landscape. Some companies, like Framework, have a diversified approach, relying on Taiwanese manufacturing for their core products. Their differentiated strategy might insulate them from tariffs, but it also serves as a reminder of the intricate web of global sourcing relationships that define the technology marketplace.

For consumers, this scenario is quite alarming. The prospect of increased laptop costs affects both individual buyers and businesses alike. While companies like Framework may mitigate impacts, the overall trend towards higher prices could elevate financial barriers to entry for technology. This is particularly concerning in an era where technology is integral to daily life, work, and education. Consumers are likely to feel the squeeze of increased prices long before they witness any beneficial shifts from companies adjusting their supply chains or manufacturing strategies.

As we navigate this evolving landscape of tariffs and pricing strategies, it’s essential for consumers and manufacturers alike to stay informed. Industry stakeholders must balance the tension between profit margins and fair pricing, especially as competitive landscapes shift. The coming months will be critical in determining not just the bottom line for companies, but also the affordable accessibility of technology for the average consumer in an increasingly complex global market.

Leave a Reply