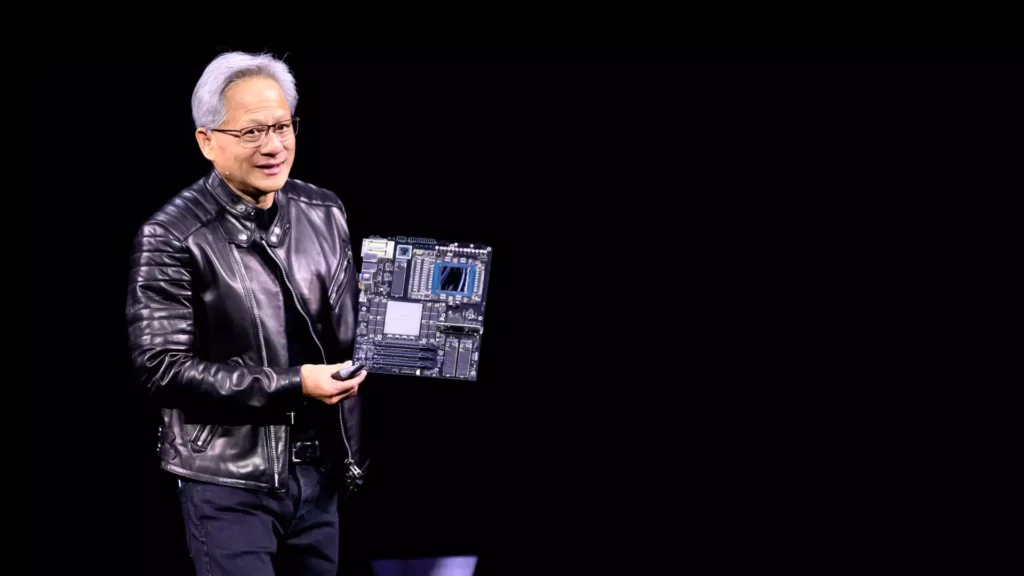

In an era where data reigns supreme, the technology landscape is not merely adapting; it’s undergoing a seismic transformation that reshapes industries. Nvidia’s CEO, Jensen Huang, recently drove this point home during a keynote that was as much a rallying cry for tech investors as it was a showcase of the company’s innovative prowess. With high-performance computing at the center of his discourse, Huang captured the essence of our times: those who invest strategically in technology now will dictate the contours of tomorrow’s digital economy.

Huang’s conviction that the premium on speed is not just a fleeting trend but an essential economic consideration is crucial. In a world drowning in data, the ability to process it efficiently and swiftly is akin to holding the winning lottery ticket. Potential high-stakes investors must recognize that the choices they make today while selecting hardware can yield significant returns in a future driven by rapid AI advancements. In a stark deviation from outdated narratives that prioritize cost-cutting over performance enhancement, Huang firmly stated, “Speed is the best cost-reduction system.” This shift implies a necessary recalibration of how ROI in tech investments is conceived.

Navigating the Competitive Terrain: The Rise of Nvidia

Huang’s address extends beyond a mere data-driven sales pitch; it serves as an important commentary on the broader competitive landscape. The conviction with which he championed Nvidia’s GPUs underscores an evolving narrative that involves not just raw capability but also an ability to adapt and excel in a competitive marketplace. The statistic that Nvidia’s upcoming Blackwell Ultra systems could potentially generate up to 50 times more revenue than prior models should resonate deeply with stakeholders. Winning in this space demands more than just hardware; it requires a commitment to harnessing advanced analytics and AI capabilities.

The tech behemoths—Microsoft, Google, Amazon, and Oracle—are racing to secure Nvidia’s rapidly evolving chips not merely as a purchasing strategy but as a vital plank in their long-term competitive strategies. The landscape is no longer static; it is in a perpetual state of flux, which elevates the need for ongoing investment in robust, next-generation technology. It’s emblematic of an industry-wide realization that today’s investment in high-quality infrastructure is tantamount to future-proofing one’s business.

Future-Proofing through Evolution: Nvidia’s Innovative Chip Roadmap

Huang’s relentless drive towards innovation, backed by a strategic forecast into the late 2020s, provides vital intelligence for savvy investors planning expansive AI data centers. In a climate characterized by hefty capital expenditures—often climbing into the hundreds of billions—companies cannot afford to gamble blindly on inferior technology. Nvidia’s strategic roadmap not only lends credence to their commitment as a long-term partner in innovation but also sets expectations for stakeholder decision-making capabilities.

These investments in future technology, particularly the Rubin Next and Feynman AI chips, signify not merely a tech upgrade but an evolution of thought processes in risk management and capital allocation. The pressure on stakeholders to get their budget approvals in order isn’t merely a financial necessity; it’s a survival tactic in a rapidly evolving landscape. Huang’s pragmatic approach to commanding investment strategies is revealing; he advocates for proactive measures rather than reactive responses.

Innovation and Adaptability: The Crucial Competitive Edge

Importantly, Huang’s comments on the limitations of Application-Specific Integrated Circuits (ASICs) invite critical scrutiny into the types of investments many enterprises are currently making. While ASICs may parade their tailored functionalities, their inflexibility amidst dynamic AI applications presents a fundamental flaw that could lead to detrimental consequences. Huang’s assertion that “a lot of ASICs get canceled” serves as a cautionary reminder—the technology landscape demands adaptability and versatility, attributes that Nvidia’s GPUs possess in spades.

In a fast-paced market that thrives on innovation, companies must reevaluate the notion that more is intrinsically better. The tech-savvy investor must recognize that investing in adaptable solutions invariably leads to sustained success. This poignant critique should resonate with decision-makers who risk becoming mired in the allure of hyped-up technologies that fail to deliver essential versatility and performance.

Huang’s insistence on choosing not just “any chips” but the “right chips” carries an underlying message that embodies the strategic foresight required in today’s information-driven world. The reality is simple: failure to adapt and innovate will leave many companies behind in this technological race. In a battle for supremacy driven by speed, it is those who make judicious choices regarding their technological investments who will emerge victorious at the finish line.

Leave a Reply